Life Insurance in and around Nashua

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

When facing the loss of a loved one or your partner, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and try to move forward without your loved one.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Put Those Worries To Rest

Having the right life insurance coverage can help loss be a bit less stressful for the people you're closest to and provide space to grieve. It can also help cover matters like your funeral costs, future savings and utility bills.

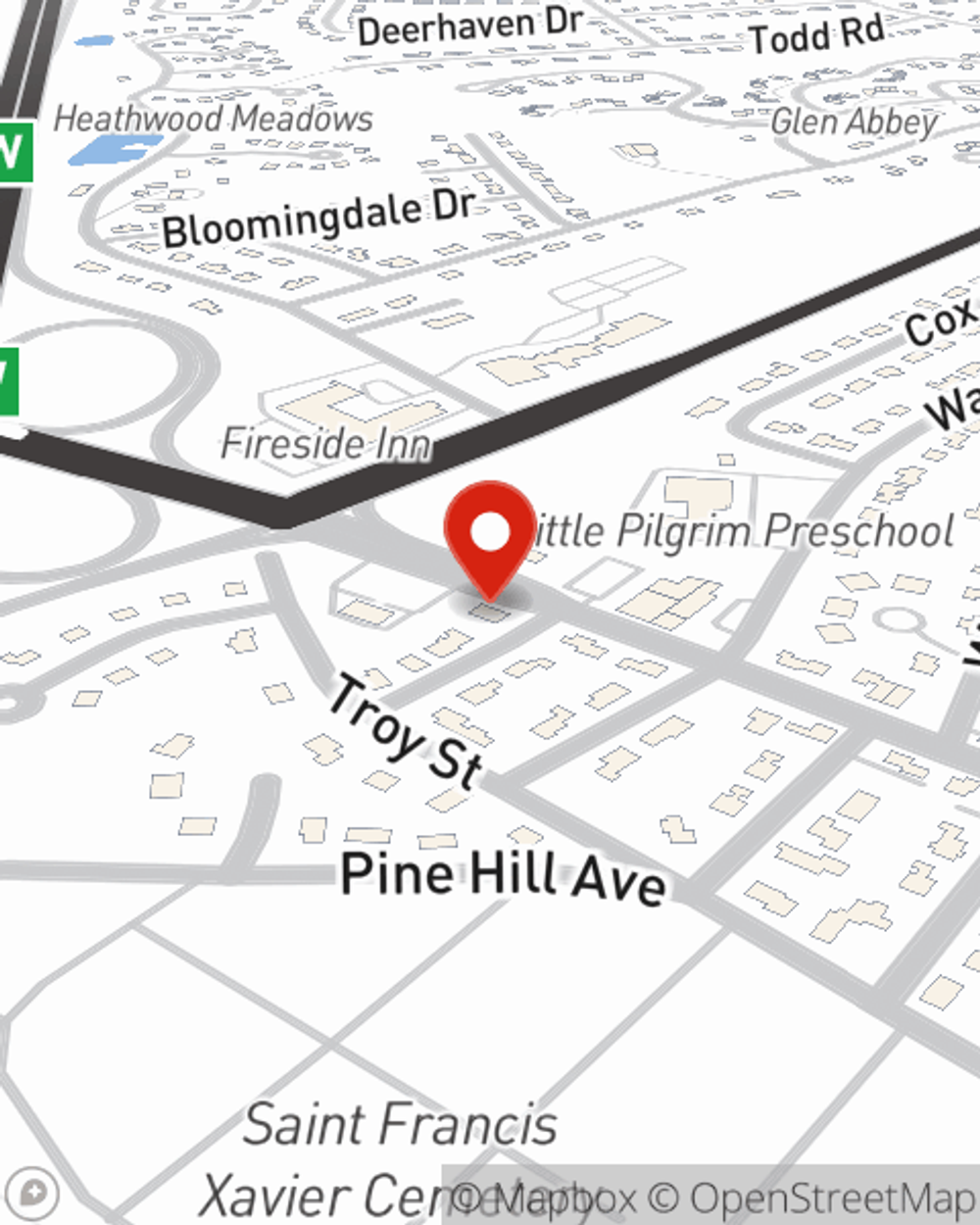

If you're looking for reliable protection and responsible service, you're in the right place. Talk to State Farm agent Peter Schuler now to get started on which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Peter at (603) 882-4190 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Peter Schuler

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.